When thinking about investments, I think it’s helpful to think to break down based on these two categories:

• Appreciates vs depreciates: Is the thing you’re buying likely to go up in value? Anything with a motor or wheels is very likely to plummet in value.

• Productive vs unproductive: Does the thing you’re buying generate income just by owning it? Commodities like gold and oil may go up in value but they don’t produce income until you sell them.

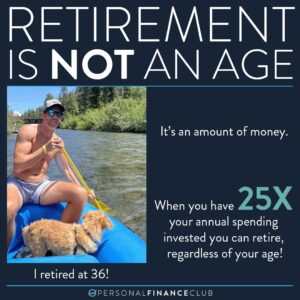

Wealth is created in that bottom right quadrant. When you own things that produce income AND go up in value, you realize the multiplicative impact of compound growth. Use the income to buy more of the productive appreciating asset, and your wealth grows exponentially over time!

That’s why I primarily only invest in two things: Investment real estate and index funds! Between the two, I actually prefer index funds because they require way less work (but mad respect to all the real estate investors out there!)

And if you’re gonna come at me for calling your primary home a depreciating asset… well, you probably didn’t read this far in the caption. BUT here’s my rationale anyway: After you account for mortgage interest, taxes, insurance, maintenance, etc on average homeowners lose money on their homes! That makes it a liability, not a productive asset!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram

September Sale!

September Sale!