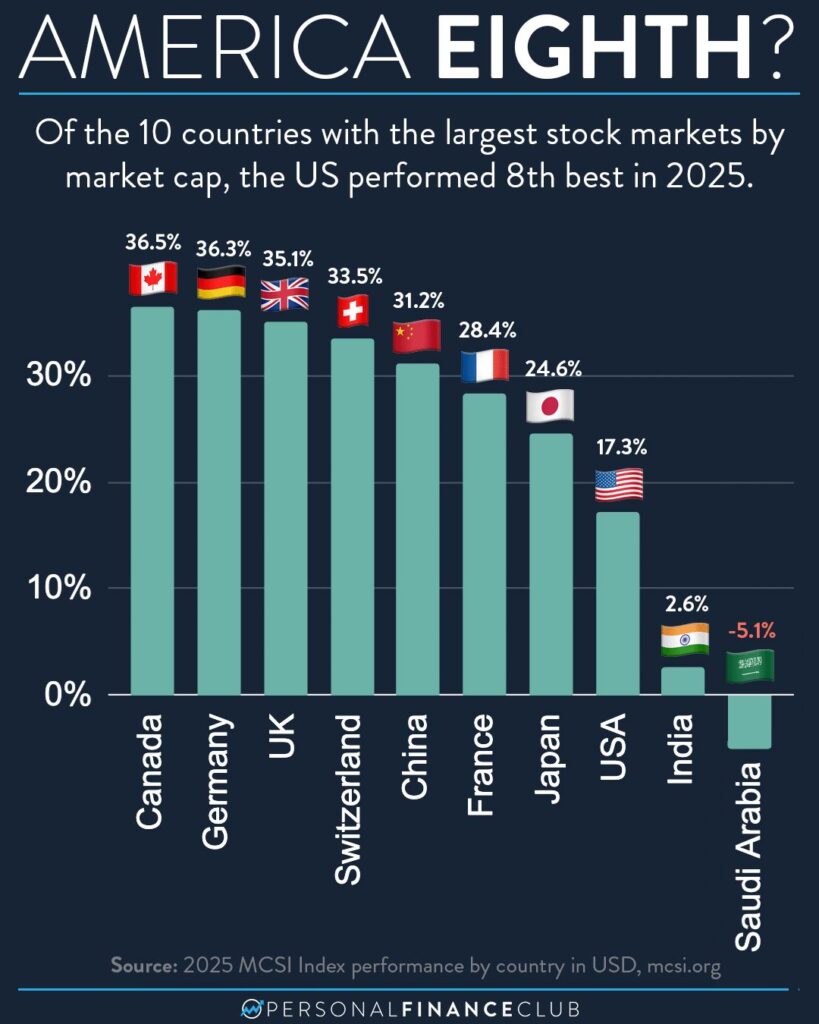

Some investors think you should only invest in the US stock market. Their reasoning? The US stock market performs the best, so why would you invest in all those other countries?!

THAT mentality is demonstrating two fallacies:

• Short term memory

• Chasing past performance

The last few years before 2025, the US has absolutely performed better than most other markets in the world thanks to the AI and tech boom of huge tech companies that are headquartered in the US. But to look backwards and say “Hey the US has performed better in the past, therefore it will perform better in the future” is faulty logic. In fact, if you go back further than just a few years, US vs International is more of a pendulum. Sometimes the US has 5-10 years of outperformance, sometimes non-US has 5-10 years of outperformance. But guess what wasn’t announced in January of last year: Which country is going to perform best. That sort of thing is, unfortunately, never announced in advance.

So what do you do? Buy both. Here’s a look at two popular ETFs from Vanguard and their 2025 performance:

• VTI (US Stock market): +15.9%

• VXUS (Non-US Stock Market): +28.2%

So if you’re “All in VTI” you would have underperformed VXUS by an eye-watering 12.3% last year. Ouch! But since we can’t know which one will do better going forward, do what I do: Buy both! Then you guarantee yourself the global upside, without subjecting yourself to single-country risk.

And since it’s the new year, I WILL tell you whether US or international will perform better for 2026: I HAVE NO IDEA. I’m doing what I always do. Buy it all early and often. Stay the course. Ignore the noise. Keep investing like a sociopathic robot.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!