You may have heard about record setting levels of inflation we’re experiencing recently! Well, it’s not really a RECORD. In the late 70s and early 80s we experienced inflation over 13%! And in the 1910s it surpassed 20%! I’m going to make a few posts about inflation over the upcoming days, but I thought I’d get started with what IS it!

Maybe you’ve heard that cash loses value over time. That’s not QUITE true. If 40 years ago you buried a $20 bill in your backyard and dug it up today, it would still be worth $20. The problem is, 40 years ago, that $20 would buy a lot more STUFF. For example, in 1982 you could buy about 16 gallons of gas for $20. Today you would only get about SIX gallons.

Of course, not all goods and services go up in cost at the same rate. Some things even DECREASE. (i.e. the US Bureau of Labor Statistics estimate that prices on TVs have dropped by about 99% since 1950, a rate of -6% per year). So this one “inflation” number that we discuss is an attempt to average out how much more ALL stuff costs over time.

Economists generally agree that a little inflation is actually good! If people know that stuff is going to cost more in the future, it gives us an incentive to SPEND that money today instead of hoarding it. Spending on goods and services or investing that money instead of letting it sit is what fuels the economy!

That said, Economists would also tell you we definitely want to avoid HYPERinflation. That’s when inflation gets out of control. This happened to Zimbabwe from 2007 to 2009. At the peak, they experienced 79 BILLION PERCENT inflation in ONE MONTH. (That’s an annualized rate of 89 sextillion percent… ouch). They actually printed a 100 trillion dollar bill!

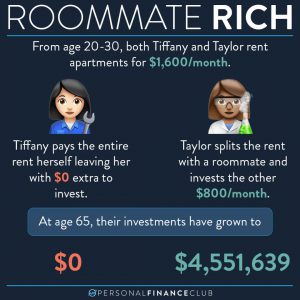

What to do about all this?! Well, it’s even more reason to not hold a lot of money in cash. Get that money INVESTED so it can grow and outpace the cost of inflation! 🙂

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram

September Sale!

September Sale!