Mutual funds can be kind of intimidating. But the idea is actually pretty simple. It’s just a bunch of people pooling their money together so it can be invested together.

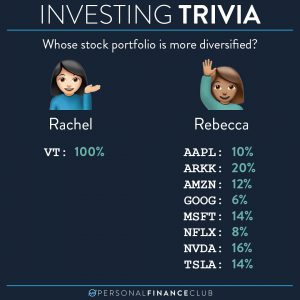

As an individual investor, you could go and buy a big portfolio of thousands of stocks, but that’s logistically inconvenient or unrealistic. For one, you might simply not have enough money to buy even one share of all the different stocks you want. Plus, you probably don’t want to spend your whole life figuring out what stocks and how much of them to buy.

That’s where mutual funds come in. Instead of picking the stocks yourself, you just contribute cash to the fund. Then the fund manager buys all the stocks for you. All the growth and dividends come right back to you in proportion to how much money you put in. So if you invest $1,000 in a mutual fund and the value of the stocks inside go up by 10%, your investment will go up by 10% and it will be worth $1,100.

You can generally move your money in and out of a mutual fund whenever you want. They only trade once a day at the close of the market, so you can’t day trade mutual funds. They’re designed to be bought and held.

The concept of a mutual fund is pretty generic. Almost anything can go inside. Stocks, bonds, cash, CDs, other mutual funds, etc. They also all have an “expense ratio” charged annually to handle the cost of managing them. Some are very cheap around 0.04% or lower. Some are very expensive, over 1% or higher.

Note that my favorite type of investment, index funds are just a special type of mutual fund. Instead of the manager charging a high fee to pick and choose stocks at their discretion, index funds auto-buy ALL the stocks in a list (i.e. index) in proportion to their size. The broad diversity and low expense ratios of index funds have been proven to beat the “actively managed” mutual funds in the same categories.

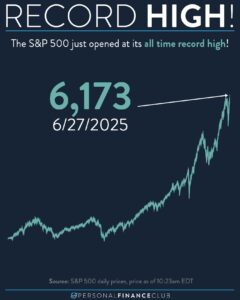

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy & Jenn

September Sale!

September Sale!