As interest rates have started to drop, it may be time for some mortgage borrowers to keep an eye on mortgage rates in case it makes sense to do a refinance. The benefits are that you pay a lower interest rate on the remaining loan balance, resulting in a lower monthly payment. (Or you could keep the same monthly payment and shorten the remaining term of the loan.) The downside is that there are significant costs associated with the the refinance.

The exact math on when to refinance is a little bit complicated. It depends on your current rate, loan balance, term remaining, and all the refinance fees (title, appraisal, insurance, origination, etc). But it turns out, other than the fees, changing those other numbers around don’t impact the net result that much.

The takeaway for me is this: At a 0.5-1% rate improvement the costs are likely too much to make it worth it. You’ll be making payments for 4+ years and still in the red due to the fees. It’s probably better to hold off and wait to see if rates keep dropping.

But around 1.5%-2% rate improvement you’ll realize most of the benefits of the new lower monthly payment and have a shorter breakeven term.

So if you’ve recently taken out a mortgage at a high rate (6%+) it will probably be worth keeping an eye on new mortgage rates over the next couple years until you get into that 2% rate improvement range.

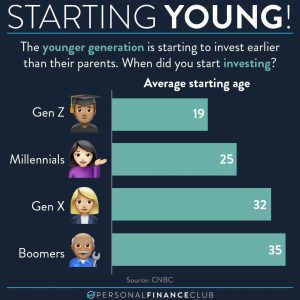

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!