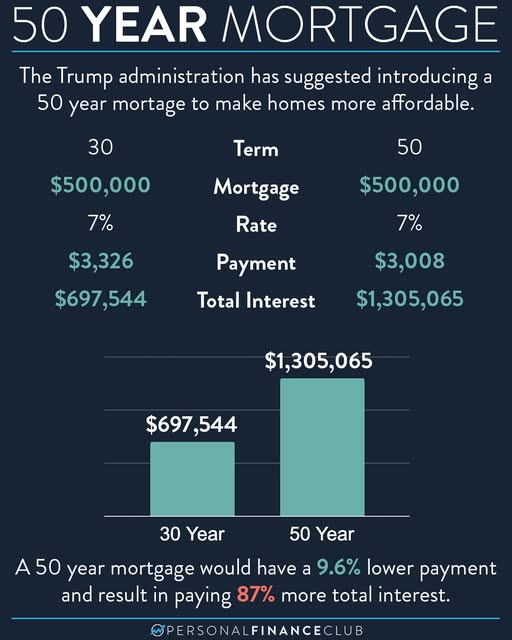

The numbers are eye watering. If you were to borrow $500K at 7% interest on a 50 year term, you would end up paying over $1.8M in payments on that loan. The original $500K plus over $1.3M in interest. Ouch!

For consumers, yes, your payment is a little lower, but that also could increase housing prices even more as EVERYONE will be able to “afford more” house. The 50 year term means you’re barely paying down the principal for DECADES. For all you gungho-pro homeownership fans out there, doesn’t this start to feel like being a lifelong renter from the bank/government/insurance company?

For lenders, locking into a fixed rate for FIFTY YEARS makes virtually no economic sense. Even the 30 year fixed only exists because the government guarantees to banks they’ll buy up all those loans. This would further saddle the government with the risk of crappy-low yield loans in a high rate environment. That cost and risk gets passed on to the government, and ultimately us tax payers.

I’ve always been a fan of paying down your mortgage FAST (once you’re investing enough to be on pace for a healthy retirement). Extending a mortgage term from 30 to 50 years doesn’t excite me. It seems like very little upside, in exchange for a lot more systemic risk and a TON more total interest paid by borrowers.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!