The other day I got a message from a follower who told me that her investments weren’t working! She started a year ago and her investments had only grown to $32,000! I asked her how much of that she had contributed and it was $26,000. That’s a total return of +23% in a year, but since was contributing monthly (and not all at the beginning of the year) her actual rate of return was more like 40%! (It’s only so high because the market was at the bottom of a very sharp drop a year ago, but still a fantastic year.) In fact, if her contribution rate and rate of return continued at that clip she would be a billionaire in 28 years. And the richest person on the planet just an additional 15 years later.

Yet when she messaged me her gut said IT’S NOT WORKING. That’s because long-term investing and compound growth takes a while to get rolling. In the beginning, the growth is small and MOST of the money is just what you put in. But each year that goes by the growth gets bigger and you get increasing impact from the growth of previous years’ growth. In the (much more realistic) example in this image, the first year’s growth is only a measly $627. But in year 40, even though your contribution is still just $500/month, the annual growth has increased to $277,517 per year! WOW!

So remember to think long-term. The first year or two will feel slow, but as the years go on, as long as you leave your investments to grow and keep contributing compound growth will take over and the numbers will get bigger and bigger!

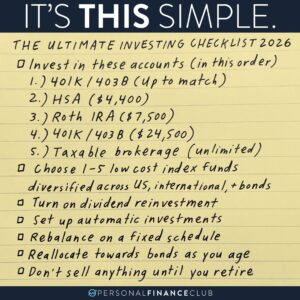

If you’re wondering HOW to get a 10% annual return, that’s about what the US stock market has averaged over the last 100 years. You can create a direct line from that growth to your bank account by buying and holding index funds!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram

September Sale!

September Sale!