There are no hard and fast rules when it comes to this stuff. This is just one example. The actual tax implications of getting married can be different based on your incomes, deductions, credits, etc. But, generally speaking, when incomes vary greatly, you are more likely to experience tax benefits when getting married and filing jointly.

In this example, we are assuming you take the standard deduction. The equation can change if you itemize and bump up against the state and local tax (SALT) cap.

You may have heard about a marriage tax penalty before. This used to be very common. But Congress has been working to change the tax code in recent years, so almost all of the tax brackets for couples filing jointly are double the brackets for filing single. In other words, there is very rarely a tax penalty when filing jointly with your spouse these days.

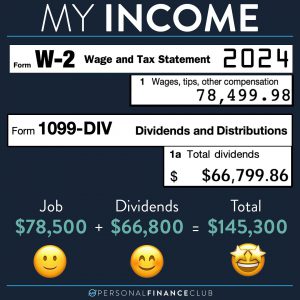

There is definitely such a thing as a “marriage bonus” though. This can occur when a couple files a joint tax return and one spouse earns significantly more than the other. Filing together can move a portion of the higher earner’s income into a lower tax bracket. As a result, the couple may enjoy a lower tax burden together than if they each filed separately.

So, should you rush off to Vegas and get married to try and save a few thousand dollars on taxes?? No, that probably wouldn’t be a wise decision (although it might make for a good story). There are a lot of factors that should decide if getting married is right for you, and tax consequences should be very low on that list!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane

September Sale!

September Sale!